Credit Cards

Credit CardsYour guide to being a credit card super churner in Canada

This article has been updated from a previous version. Want to score a free flight or hundreds of dollars ...

Find the right credit card.

Get StartedFocus On

When you compare cash back credit cards, look at the rewards rates they offer relative to their annual fees. Some cards have great rewards rates that let you earn at least 2% cash back but then charge a big annual fee. You'd have to spend a lot of money on a card like that to make the premium rewards rate worthwhile.

Savvy shoppers should estimate how much money they'll spend with their cash back credit card each year and choose a card accordingly. Big spenders will benefit from premium cash back cards offering high rewards rates. Lower to middle-income consumers will find that standard cash back cards make more sense.

You should also think about the kind of items you spend money on each month. Many cash back cards offer higher rewards rates for certain categories of purchases, like gas, groceries, and recurring bills. If you spend a lot of money on one type of item, look for a cash back card that gives you an optimal rewards rate on it.

Check out our table below to see the rewards rates and benefits on some of our most popular cash back cards:

Card |  |  |  |  |

|---|---|---|---|---|

Rewards | 1% on gas/grocery/drug store purchases and on recurring bills. 0.5% on all other eligible purchases. | 2% on recurring bills, gas/grocery/drug store purchases. 1% on all other eligible purchases and after annual $25,000 limit. | 1% on all eligible purchases

| 4% on drug store purchases and recurring bills 2% on gas/grocery purchases 1% on other purchases and after annual $25,000 limit |

Interest rate | 7.99% 19.99% after 6 months | 19.99 %

| 19.99% | 19.99% |

Annual Fee | $0 | $39 | $0 | $120 |

| Get this card | Get this card | Get this card | Get this card |

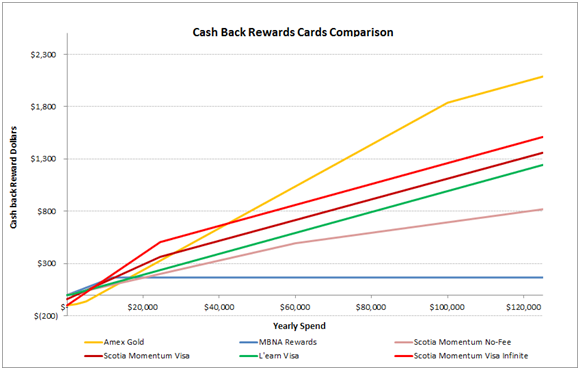

We put a selection of cash back credit cards head-to-head in the graph below so you can see which one comes out ahead based on the amount of money you spend annually.

A note on methodology: Because cash back rewards rates vary based on what you're buying, we used a weighted basket to represent the average cardholder's monthly spending:

This basket represents up to $60,000 of spending, beyond which all purchases are categorized as 'other'. After all, most families only spend so much money per year on gas, groceries, and recurring bills, no matter how big their budget is. We also included the annual fees on each card and stripped out introductory or promotional offers. Now you can get a better idea of how each card will reward you over the long term.

The graph is clear: premium cash back offerings come out ahead if you spend more than $20,000 per year on your card. If you spend less, lower-tier cards with no annual fee are a better option.

50+ trusted partners (and growing) on our site to compare mortgage rates, insurance and credit cards

$1 billion+ saved in interest and fees

14+ million Canadians helped per year

Looking for more credit card info? Check out our Help Centre.

The appeal of a cash back rewards card is easy to understand. Who doesn't like earning cash as they spend money on their credit card? With better cash back credit cards available today than ever before, it's easy to find the perfect card — especially if you compare your options right here at LowestRates.ca.

LowestRates.ca may receive compensation when you click on links to those products or services; however, our content and calculations are objective and free from bias. The opinions expressed are purely those of LowestRates.ca; thus, partners are not responsible for any editorials or reviews that may appear. For current term and conditions on any advertiser or partner’s product, please visit their website.

Credit Cards

Credit CardsThis article has been updated from a previous version. Want to score a free flight or hundreds of dollars ...

Credit Cards

Credit CardsThis article has been updated from a previous version. A decade ago, you probably wouldn’t have hear...