Most Canadians aren't researching their options before buying financial products

By: John Shmuel on August 15, 2017

The vast majority of Canadians head online to compare whenever they’re planning a flight overseas, or looking to book a hotel for the night. It saves them both time and money — no need to call around and ask for prices, they’re all there for you online.

But when it comes to financial products, our latest survey found that most Canadians don’t bother to compare. Less than half are actively researching their options when buying mortgages, car insurance or applying for new credit cards.

This disconnect is costing Canadians a lot of money every year.

"The massive gulf between Canadians who compare travel options and financial products is disappointing. Because the latter is where you save real money," says Justin Thouin, our CEO and co-founder.

Let’s take a look at the numbers.

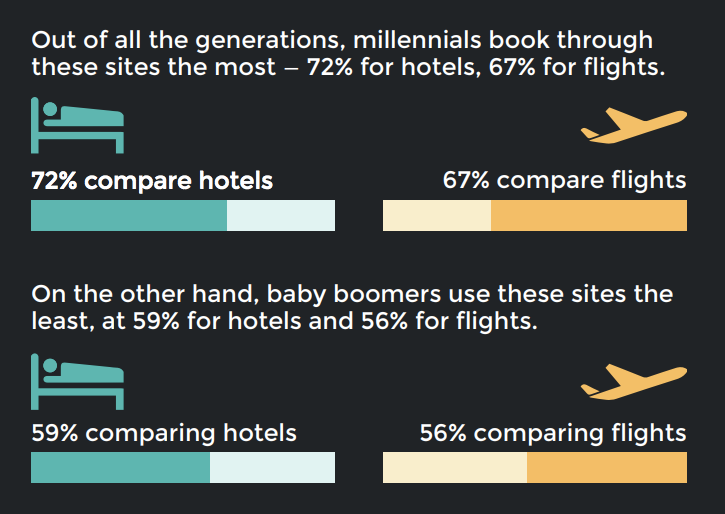

We found that 60% of Canadians use comparison websites to book their flights, and 63% use them to book their hotels. When it came to young people (those aged 18-34) we found that those numbers rose to 72% and 67%, respectively.

We get it. Booking a hotel and flight is exciting — you’re travelling!

But booking the cheapest flight is going to save you, at most, a couple of hundred dollars.

Meanwhile, when you’re buying a financial product, you’re looking at something that is going to continue to cost you fees and interest for many years. Saving money on mortgages and car insurance really add up over time. In Toronto, the average price for a single-detached home now costs more than $1 million — it’s not uncommon to have a million-dollar mortgage.

The difference between getting a 2% or 3% interest rate over your term or is quite substantial — it’s $10,000 a year, in fact.

But when it comes to doing research, most Canadians consult one source — often their bank — and take what they’re given.

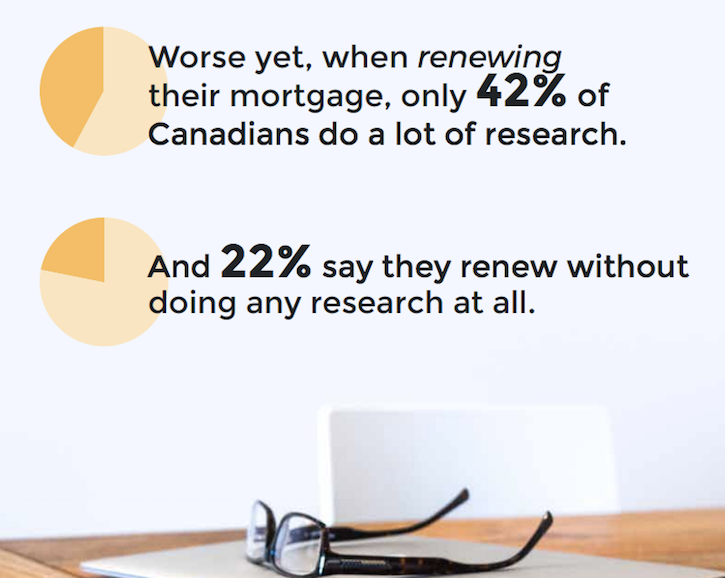

In our survey, we found that only 47% of Canadians do a lot of research before they get car insurance, while only 45% do so before getting a credit card. For mortgages, that number rises to 60% — but it falls to 42% when it comes to renewing a mortgage.

Worse yet, there’s a massive generational gap. Baby boomers all fall below the 40% mark when it comes to researching various financial products before they buy them. There is a bright spot in our report: millennials are much more aware of the need to research. 52% are comparing car insurance, 50% compare credit cards and 48% compare mortgages.

Still, this is a big gap compared to the amount of research that goes into flights and hotels. It’s not a stretch to say this lack of research is costing Canadians, collectively, millions of dollars a year. We’re leaving a lot of money on the table.

Let’s start comparing our options.

For the full survey results, click here.