REPORT: Car insurance prices fell in the first quarter, COVID-19 rebates deliver relief

By: Alexandra Bosanac on July 12, 2021

Finally, some good news for drivers: across the country, car insurance prices fell in the first three months of 2021.

The decreases appear to be linked to COVID-19. As we’ve reported before, many consumers have downgraded their driver status to ‘pleasure’ from ‘commuter.’ Doing this reduces the price of car insurance on an individual policy and is subsequently reflected by our index.

Fewer people commuting to work has also led to a sharp decrease in the number of claims insurance companies have to field. Insurance providers passed on those savings to consumers in the form of rebates and discounts.

Key insights from the report:

- The previous quarter was especially good for Ontario drivers. Premiums in Ontario have fallen sharply for the first time in years.

- More young people are applying for quotes on LowestRates.ca. This would normally push the overall price of insurance up, but prices for this group fell. We attribute this to widespread pandemic discounts, as well as more young drivers are choosing usage-based insurance. The latter is growing in popularity.

- Insurance providers are more eager than they’ve been for many quarters to extend coverage to new customers in Ontario and Alberta, which has exerted downward pressure on prices.

- It’s uncertain whether the downward trend will continue but early data look promising. New auto insurance regulations in Alberta and the Atlantic provinces may prove to be successful in making insurance more affordable to consumers.

Before we go further, a quick note about how to read the Auto Insurance Price Index and how you, the consumer, can use the information.

The index is created from the hundreds of thousands of insurance quotes we get every year and shows whether prices in your province are rising or falling. Here’s how it works: Our baseline is set at 100. This means that if our index increases from 100 to 101, prices have increased by roughly 1%. (One thing to note: this index doesn’t factor in inflation.)

Next, how can the index help you find a cheaper car insurance policy?

If you currently have insurance, check to see how your renewal rate is comparable to the average increase/decrease listed on the index. Even if your rate matches the index, it may still be possible to find a lower rate, especially if you’ve recently celebrated a milestone birthday.

Being aware of the long-term trend of car insurance prices drives home the importance of shopping around for insurance.

Now, let’s take a look at the index and the change in the average car insurance rates by province.

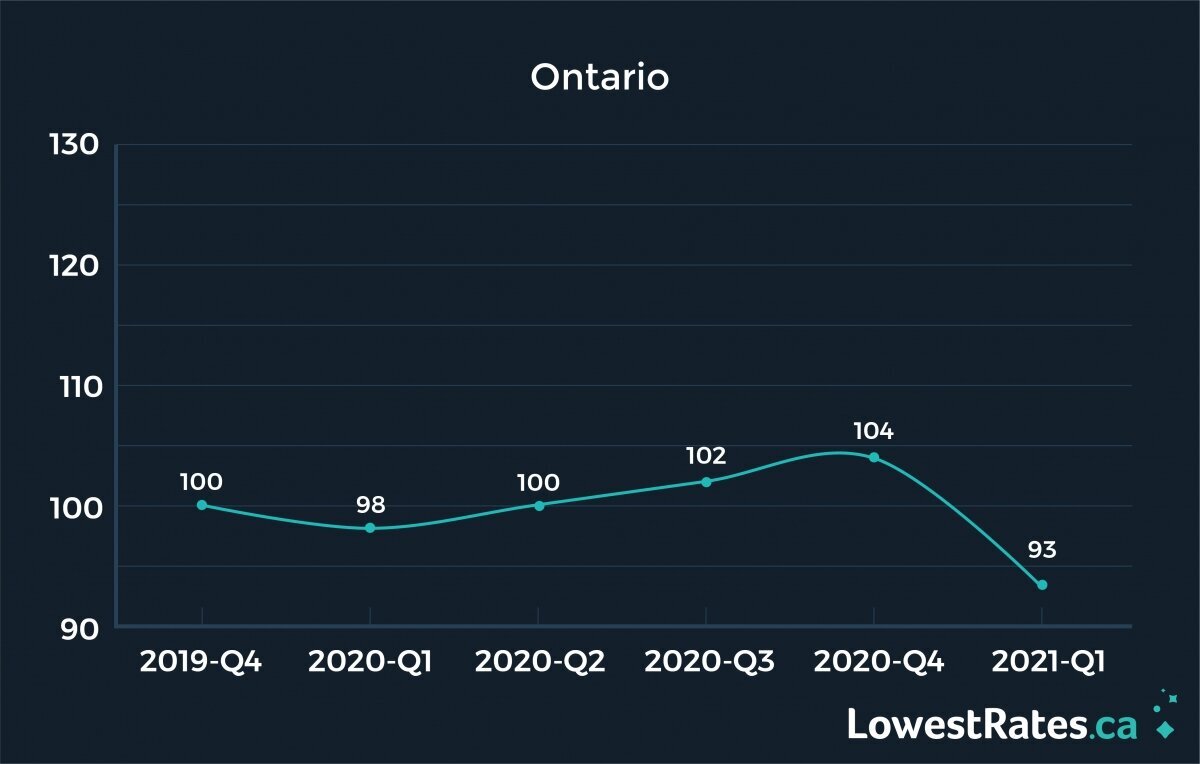

Ontario

QoQ change: -10.3%

YoY change: -5.1%

Premium change (%) by age year-over-year

| Under 25 | -0.7% |

| Ages 25 to 49 | -5.7% |

| Ages 50+ | -16.2% |

Premium change (%) by gender year-over-year

| Female | -6.0% |

| Male | -5.1% |

Car insurance prices in Ontario dropped in a big way in the first quarter of 2021. This marks the first time in years that drivers in the province have seen the average price decrease.

In our last report on car insurance costs, we predicted pandemic conditions — lower claims, more discounts — would eventually lead to lower prices. It appears that consumers are realizing those savings even earlier than expected, with prices down 5.1% year-over-year and 10.3% compared to the previous quarter.

A major driving force behind this is the fact that ‘rate availability’ improved. In the insurance world, this means that more auto insurance companies were willing to insure new customers.

In addition, insurance companies, including ones quoted on LowestRates.ca, have handed out COVID-19 rebates to customers, since claims (the chief explanation used to justify rate increases) have fallen during the pandemic.

The rebates applied to new customers as well, not only to renewing customers. Instead of being rebated, new customers were offered cheaper insurance rates from the jump.

A number of insurers even offered a second round of rebates. Insurers that offered further reductions included Aviva Canada, belairdirect, Economical Insurance, Intact Insurance, CAA, and Travelers Canada.

Also contributing to the drop in the average rate is the fact that more LowestRates.ca users — 43% year-over-year — opted to give usage-based insurance (UBI) a try.

UBI is a technology that allows companies to monitor your daily kilometers as well as the quality of your driving. You’re offered discounts based on the data it collects at renewal, with some drivers realizing discounts of as much as 25%. However, simply indicating that you’re interested in UBI during the application phase results in a lower quoted rate.

UBI was especially popular with inexperienced drivers on our site (those with less than four years of driving experience).

Not only have more people chosen UBI, but another major insurance company has also joined the fold and made the technology available: Travelers Canada, which in 2021 introduced its IntelliDrive program.

Other demographic shifts influenced the Auto Insurance Price Index last quarter. The trend of 50+ drivers choosing lower annual miles continued and the number of drivers in this group shopping online for insurance has continued to grow (this is a trend we observed in the last two quarters of 2020 as well). Year over year, applications are up 16%.

It pays for drivers in the 50+ crowd to shop around. Prices fell 16%, according to LowestRates.ca data. That’s on top of the 12% decrease seen in the previous quarter.

Rates are falling faster for the over-50s than any other demographic. Why? For one, these consumers benefited from the discounts offered to many drivers during the pandemic. Lower than normal annual mileage means lower car insurance prices.

But more importantly, the over 50 set generally has good driving and insurance records. They often see the most price reductions as result, unlike their younger counterparts. It makes sense then that the trend would be amplified for the segment that already receives the best rates.

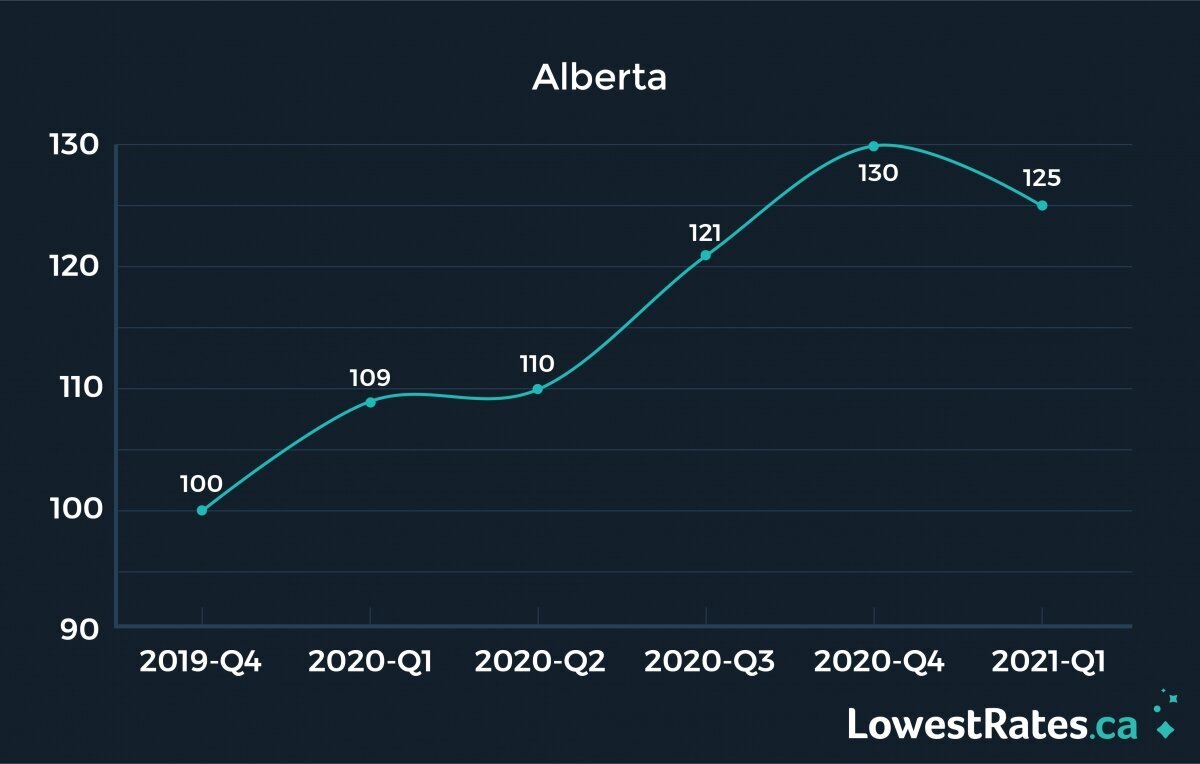

Alberta

QoQ change: -3.6%

YoY change: 14.7%

Premium change (%) by age year-over-year

| Under 25 | 8.8% |

| Ages 25 to 49 | 16.5% |

| Ages 50+ | -0.3% |

Premium change (%) by gender year-over-year

| Female | 17.5% |

| Male | 13.3% |

The first three quarters of 2021 brought some relief for Alberta drivers who, collectively, saw car insurance prices increase by double digits the previous year.

Prices have risen considerably ever since a cap on insurance rate hikes was removed in 2019 by Premier Jason Kenney. A whole year of price increases followed, adding up to a 19.2% increase in 2020 overall, according to index data.

However, between January and March, the upward trend was tempered. Rates fell by 3.6% quarter-over-quarter. There are several factors that likely contributed to this.

Last quarter, some insurers quoted in our marketplace lowered their prices. This is likely due to COVID-19. There were fewer cars on the road as well as fewer kilometers driven. Plus, multiple insurance companies offered rebates — sometimes two rounds of rebates — to renewing and new customers. Surprisingly, the average annual premium for an Alberta driver under the age of 25 fell by $400 quarter over quarter. COVID-19 has contributed to price drops for car insurance countrywide.

Insurance companies also demonstrated a willingness to insure new customers. Many had been pulling back their business in Alberta, complaining that a government cap on pricing prior to 2019 was leading to losses.

Prices went down across all demographics we track due to improved availability. This is a reversal from the past few years where demand for coverage outstripped the number of insurers who were willing to provide it.

Something else to watch out for: regulatory changes are coming to Alberta’s auto insurance industry next year with the goal of lowering car insurance premiums.

The regulatory changes in Bill 41, passed in December 2020, will streamline the claims process, helping insurance providers spend less money on legal costs. It is believed that this can be achieved by introducing direct compensation for property damage (DCPD) wherein any repair bills following a collision in which you’re not at fault are automatically covered.

If all goes well, more relief — permanent relief — may be on the way for consumers as well as the Alberta auto insurance industry.

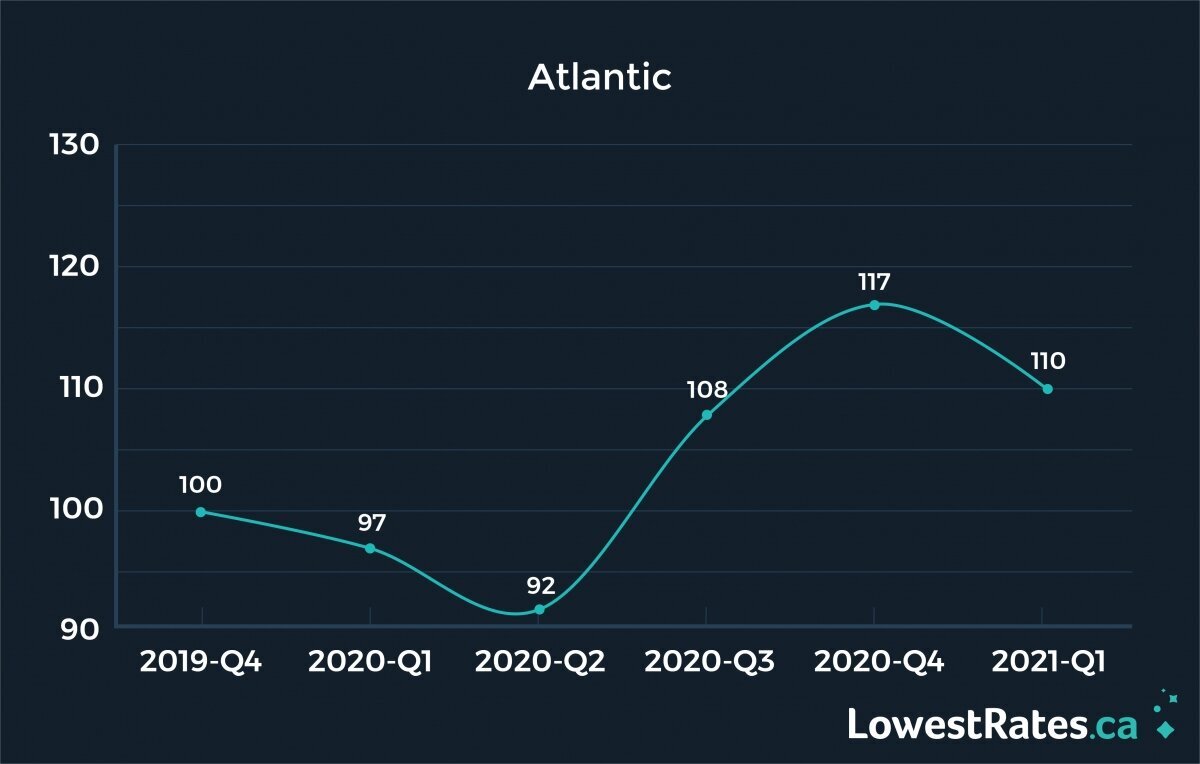

Atlantic

QoQ change: -5.6%

YoY change: 14.0%

Premium change (%) by age year-over-year

| Under 25 | 14.0% |

| Ages 25 to 49 | 16.7% |

| Ages 50+ | 7.8% |

Since we’re still expanding our service in the Atlantic provinces, we’ve amalgamated data from New Brunswick, Newfoundland and Labrador, Nova Scotia, and P.E.I. for the purpose of this report. Gender is not an approved rating factor in most of these provinces, which is why we don't include price changes for men and women.

In our last report, we noted that most insurance companies in Atlantic Canada were hesitant about offering coverage to new customers, much like the situation in Alberta.

The number of insurers willing to provide coverage to drivers remained low in the first quarter of 2021. But many drivers who quoted on our site belonged to the 50+ demographic, which brought down the average rate; compare that with last quarter, when the number of inexperienced drivers (the ones who are charged the most for insurance) applying for quotes made up a substantial bloc.

All of these factors combined likely contributed to the 7% quarter-over-quarter decrease in prices for the Atlantic region.

The factors above are ones we can observe directly from LowestRates.ca’s user data. However, a number of regulatory and market changes are likely playing into the decrease as well (more on this below). It is hoped that the changes will help even further reduce rates, which are still up 14% over last year.

Like in Ontario and Alberta, drivers in Atlantic Canada were offered rebates on their car insurance premiums due to the pandemic. In Nova Scotia, more than 20 insurance companies sought and were granted rate reductions due to COVID-19.

In addition, usage-based insurance, also known as pay-as-you-go insurance, is being adopted by more drivers in Atlantic Canada, and in Nova Scotia in particular. CAA’s popular MyPace program recently expanded into Nova Scotia in 2020. Since then, interest in UBI from LowestRates.ca shoppers in Nova Scotia has grown by 61%. Insurers in Newfoundland and Labrador and P.E.I. are now allowed to offer usage-based insurance to customers as well, so adoption rates may continue to grow.

In Newfoundland and Labrador, regulatory changes are expected to bring down auto insurance prices. The Automobile Insurance Act now states that drivers now only have to deal with their own insurance company if they’re involved in a no-fault collision. The new rules also state that insurers must now grant winter tire discounts.