This is the cheapest time of year to get auto insurance in Ontario

By: Jessica Mach on February 9, 2018

How does an auto insurer determine what your premium rate is? Trying to figure out can be a confounding process.

There are many factors that affect how much you’re charged for auto insurance. Those factors mostly have to do with your car (its make, age, fuel type, and liability to be stolen) and you, the driver (your location, driving history, age, and gender).

But the time of year when you insure your vehicle also can affect pricing, according to our data.

Over the past two years, we’ve collected data on how much drivers pay for their auto insurance rates in Ontario. More than a million Canadians have gotten quotes in this timeframe, so there’s a lot of data that tells us about how much drivers are paying, and whether seasonality impacts pricing.

Finding the cheapest prices

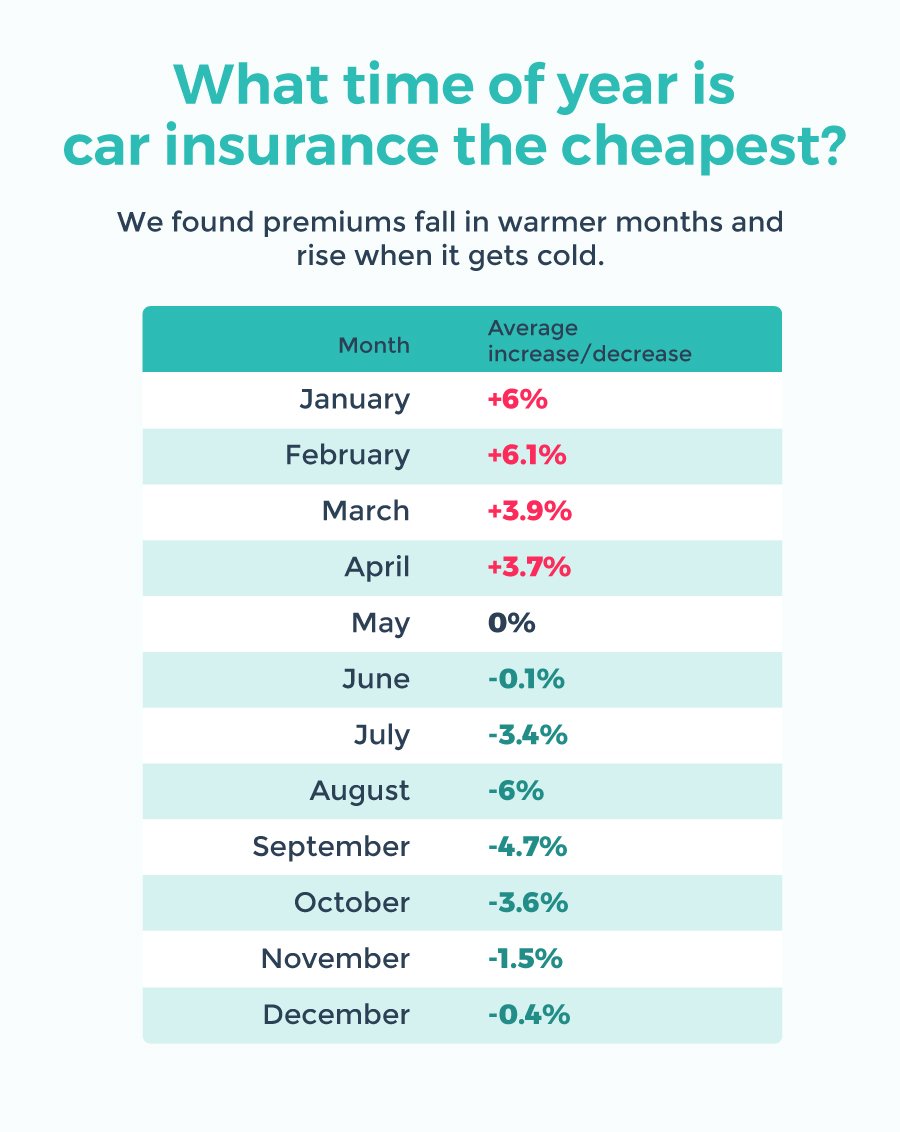

The data showed that prices are lowest in Ontario from July to October, with the cheapest time to get insurance being August. These are typically the months when car manufacturers release new vehicles as well, so insurance companies experience a high volume of new business.

Auto insurance premiums in August 2017 were 6% cheaper when compared to the average for the year. This number was similar in 2016. Premiums are most expensive in February, with the average quote being 6.1% more expensive than the average for the year.

While prices clearly go down in warmer months, there’s an argument to be made for buying in winter.

State Farm’s James Clarkson notes that because most people tend to buy cars and insurance policies in warmer months — buying your insurance in the winter will give you a better chance of getting quality attention from your broker or insurance agent.

“If you want to have a little more time paid attention to you, definitely the winter months are a better time to talk to somebody because they’ll have more time to spend detailed time with you,” Clarkson says.

Know what affects your rate

It’s not enough to buy your car when insurance is cheaper.

As mentioned, where you live, your driving history and the type of car you drive also have significant impacts on your premium, among other things.

It’s important to understand all these moving parts before you sign up for insurance. Different insurers can even weigh these factors differently. When you’re ready to get insurance, you should shop around and get quotes from a number of different companies.

Use the free LowestRates.ca quoter to compare car insurance rates from Canada's top insurance providers.

Get started